Article ID: 2025127 Last updated: 28 July 2022

You must make sure the payroll figures and details that you report to HMRC are accurate. Sometimes though, mistakes happen - and if they do, it's important that you correct them.

The method used for correcting a paycheque depends on whether or not the erroneous paycheque has already been submitted to HMRC via a Full Payment Submission (FPS).

You can delete and reprocess a paycheque that has not yet been included in a Full Payment Submission to HMRC. The new paycheque will simply replace the original paycheque and will be included in your FPS as normal.

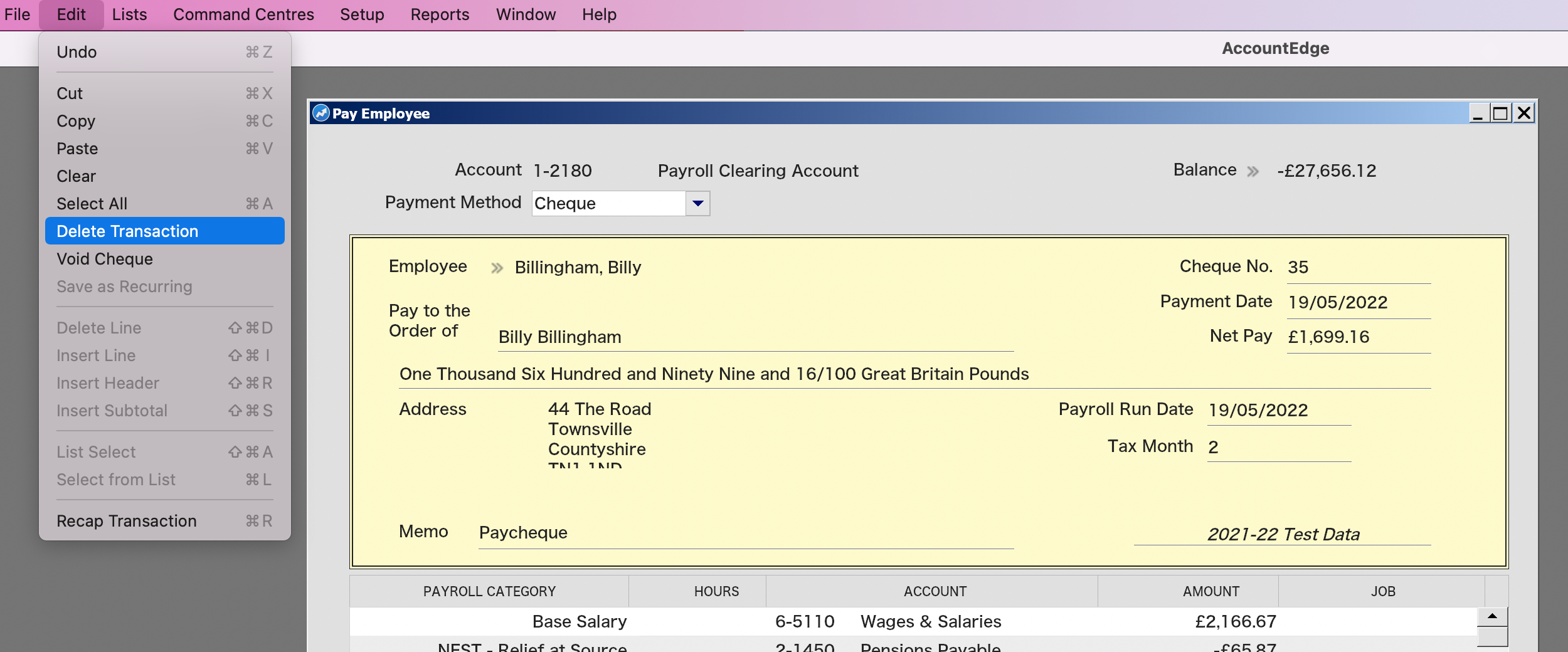

To delete a paycheque, locate and open the paycheque transaction, then select Edit> Delete Transaction.

The method for correcting a paycheque that has already been submitted via an FPS depends on when you discover the error.

For example, if you discover an error in an employee's month 5 paycheque after submitting the month 5 FPS, but before submitting that employee's month 6 FPS. You can correct the error in one of two ways:

Delete the affected employee's month 5 paycheque and reprocess a corrected paycheque. A new FPS can be submitted for the reprocessed month 5 paycheque.

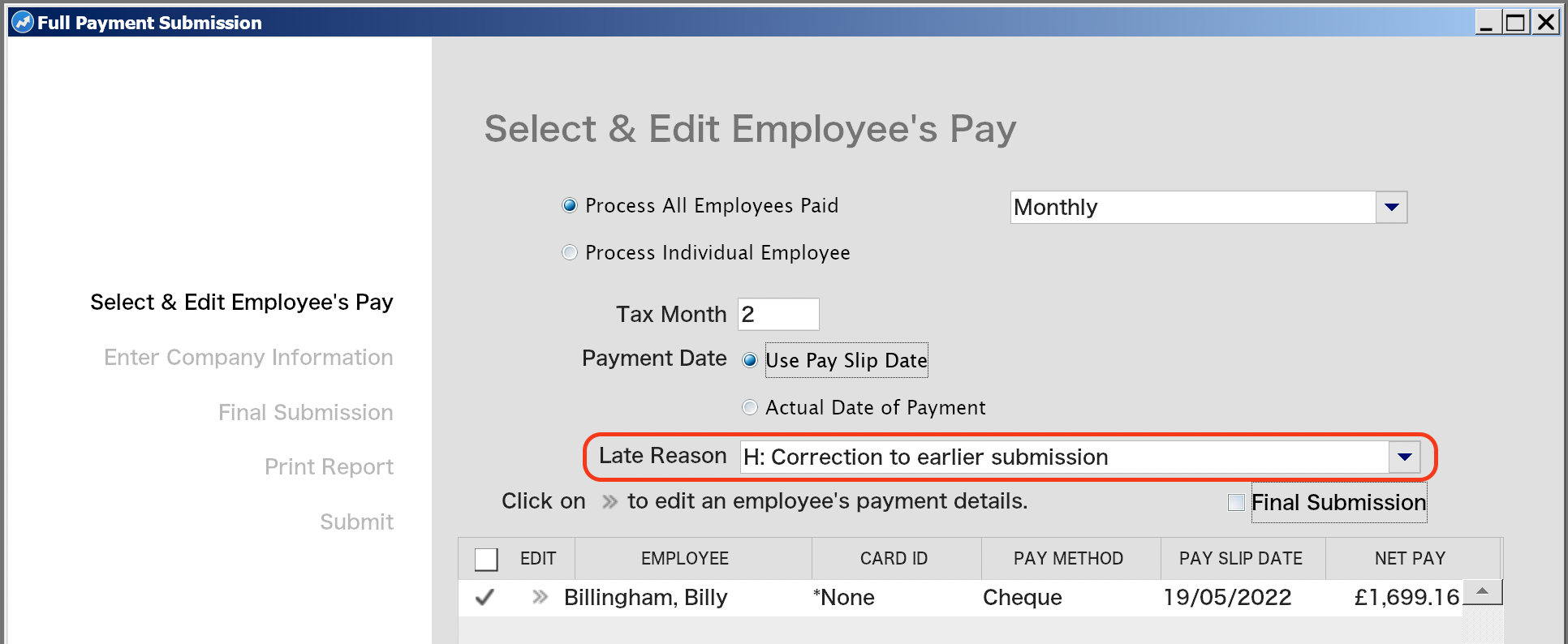

Important: When submitting the new FPS, select Late Reason: H - Correction To Earlier Submission, otherwise HMRC will assume 2 paycheques were made in the period and expect additional liability payments.

Leave the erroneous month 5 paycheque and adjust the employee's month 6 paycheque to correct the error. The month 6 FPS for the affected employee will include the adjustment and correct year to date figures.

If you discover an error after you've submitted a subsequent FPS, but still in the same tax year, you should correct the error by adjusting the employee's next paycheque.

For example, prior to submitting the FPS for month 7, you discover an error in a paycheque for month 3.

To correct this, you can leave the erroneous month 3 paycheque (and all subsequent paycheques) and adjust the month 7 paycheque to correct the error. The FPS for month 7 will contain the adjustment and correct year to date figures.

If the error relates to an employee who left your business, you must send a new FPS containing the correct year to date values as at their leaving date.

For example, in October you discover an error in the leaver's final June paycheque. To correct this, you will need to delete the leaver's June paycheque and reprocess a corrected paycheque.

Important: When submitting the new FPS, select Late Reason: H - Correction To Earlier Submission, otherwise HMRC will assume 2 paycheques were made in the period and expect additional liability payments.

If you have reprocessed a paycheque that has resulted in you paying the wrong amount of PAYE/NIC liabilities to HMRC, you should manually adjust the amount of the PAYE/NICs payment for the next tax month or quarter to correct the earlier mistake.

AccountEdge will calculate the correct liabilities in the Pay Liabilities window and on the P32 Report. Use one or both of these to confirm your total due liabilities for the affected period and / or year to date.

If you have reprocessed a paycheque that has resulted in you reporting or paying the wrong amount of contributions to your pension provider, you should contact your pension provider for details about how they would prefer you to correct the reported figures and any contributions paid.