Article ID: 2025247 Last updated: 19 January 2022

If you are using AccountEdge 2020 or earlier, please upgrade to the latest version of AccountEdge Pro.

If you import goods into Great Britain from outside the UK or from outside the EU to Northern Ireland you may have to pay import VAT on goods. For supplies of services from outside the UK you must account for VAT under the reverse charge procedure.

We recommend that you apply for a EORI number if you currently do not have one and provide this and your company's VAT registration number to your suppliers and shipping agents:

Also please keep your import VAT Certificate records for audit purposes:

We also recommend registering for Postponed VAT Accounting to help with cash flow:

We recommend you contact HMRC or your shipping agent for any accounting or VAT treatment clarifications you require.

You should no longer use the EC Purchases VAT Code that affects boxes 2, 4 and 7, 9 of the VAT return.

If you have registered for Postponed VAT Accounting, you will need to create and use a new VAT Code that affects boxes 1, 4 and 7. Full details can be found at the following gov.uk link:

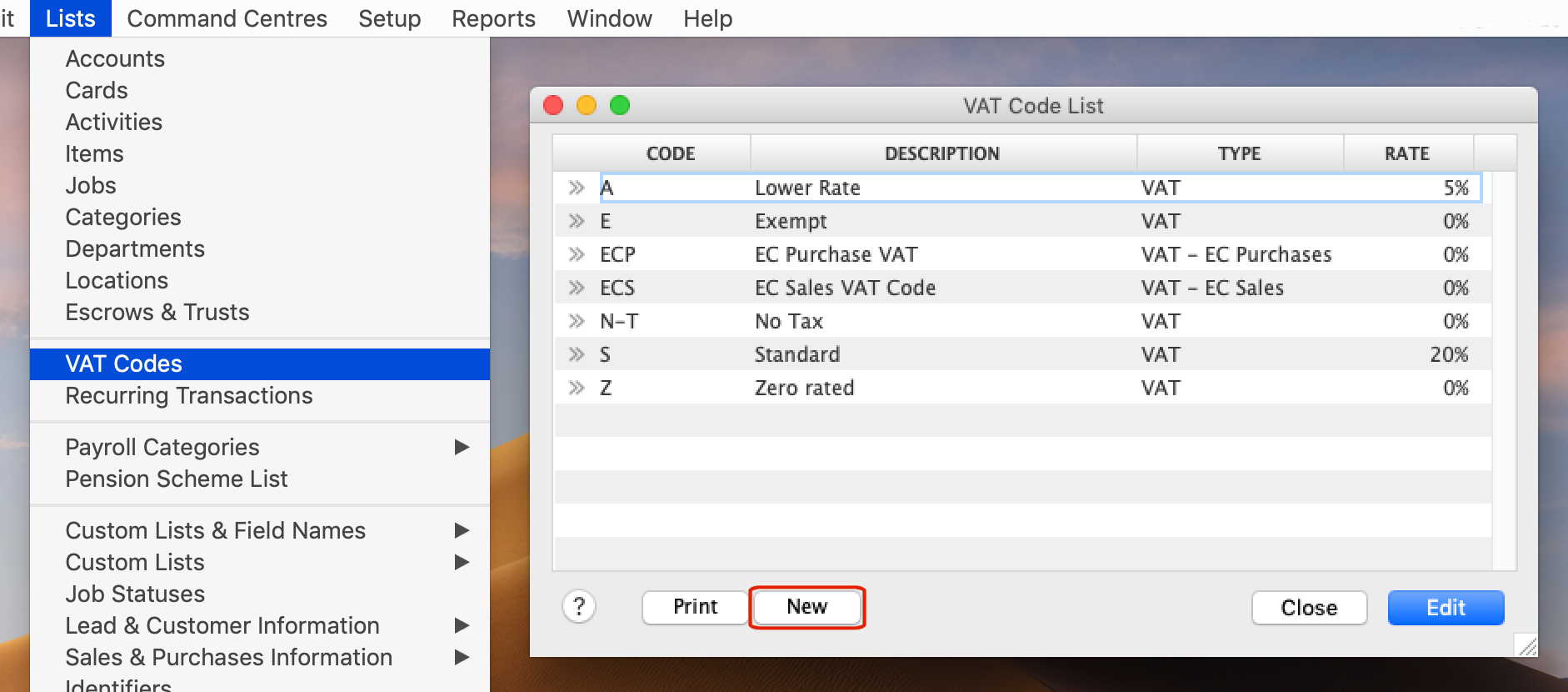

To create a new VAT Code:

• In AccountEdge, at the top of your screen select Lists> VAT Codes.

• The VAT Code List will appear. Click New.

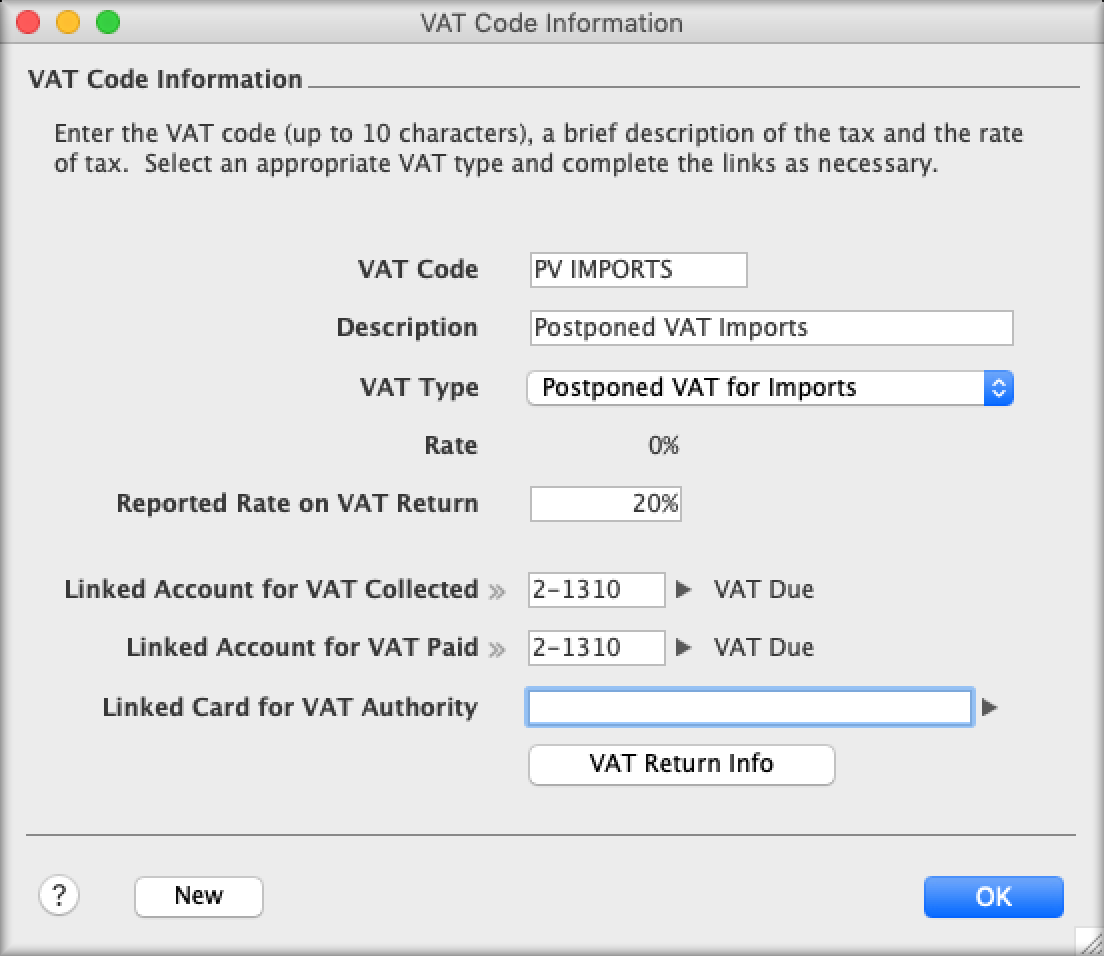

• Enter a VAT Code reference, for example 'PV IMPORTS' or similar.

• Enter a Description such as 'Postponed VAT Imports' or similar.

• Set the VAT Type to 'Postponed VAT for Imports'.

• Set the Reported Rate on VAT Return to the standard rate, currently 20%.

• Set the Linked Account for VAT Collected and VAT Paid to your VAT Due liability account (2-xxxx).

• Linked Card for VAT Authority is not a mandatory field.

• Click OK to close the VAT Code Information window.

If you know the exact value of the goods and VAT that is to be charged on the purchase invoice (the same GBP values that will be calculated by HMRC, taking into account any exchange rate differences, for example), you can record your purchase using the new PV Imports VAT Code. These transactions will automatically appear on the next VAT return.

This method can also be used if you wish to record an estimated value of goods and VAT but it should be noted that if the value of the goods or VAT is later determined to be different to your recored purchase invoice, you will need to record additional VAT adjustments. Further information can be found at GOV.UK here.

If you do not know the exact value of the goods and VAT that is to be charged on the purchase invoice (where the GBP values are to be determined later, or where you may prefer to wait for your monthly Postponed VAT Statement from HMRC), you should record your purchase invoices with VAT Code N-T. Once the GBP value of the goods and VAT have been determined, you will record a separate VAT journal entry to include your Postponed VAT values on your next VAT Return.

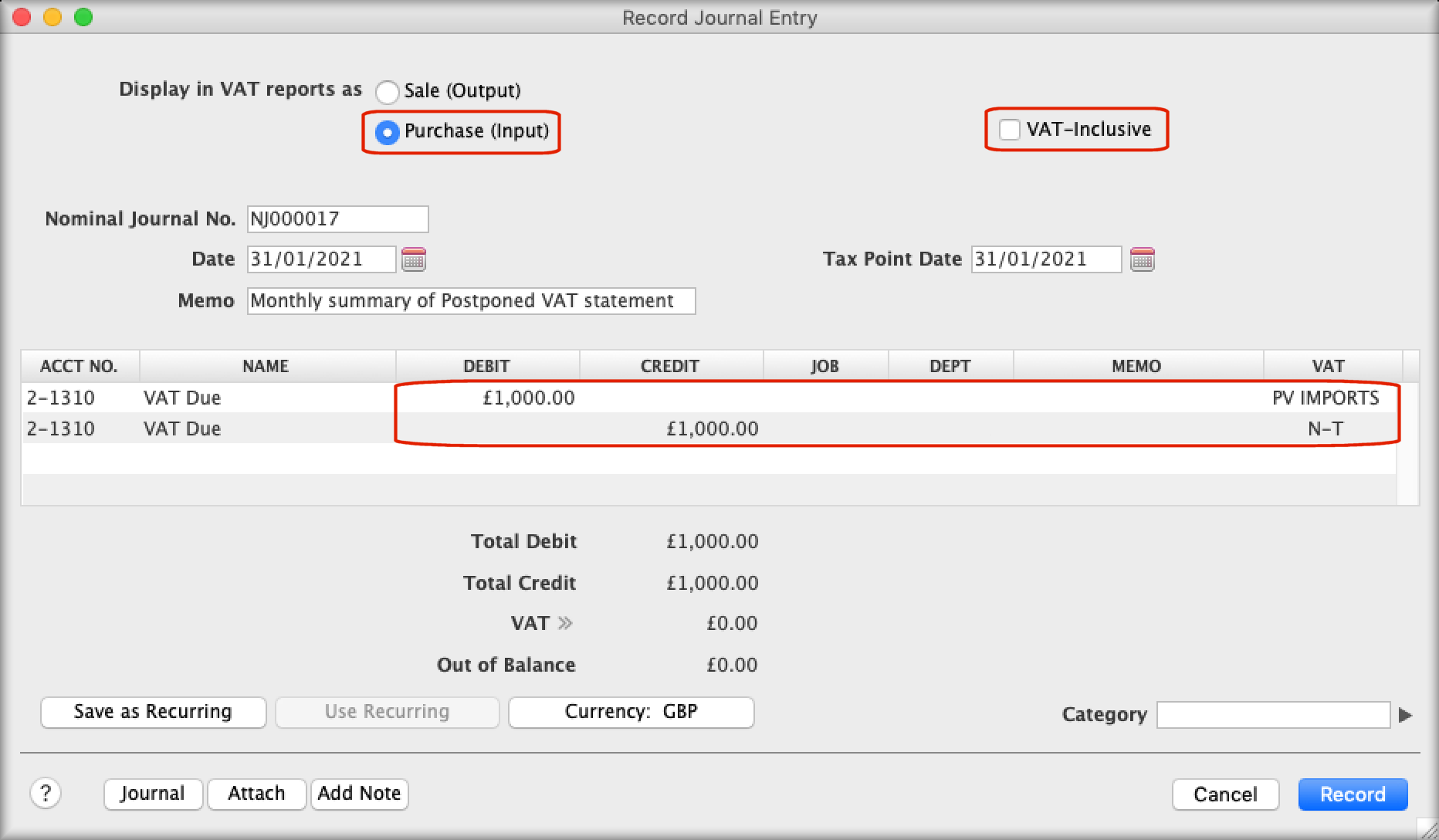

To record a journal entry in AccountEdge for your monthly postponed VAT statement:

• Select the Accounts command centre

• Click the Record Journal Entry button

• Set the correct Date for your journal.

• Set Display in VAT reports as to Purchase (input).

• Ensure the VAT-Inclusive checkbox is unticked.

• Add a memo reference, for example "Monthly summary of Postponed VAT Statement"

• For all lines, set the Account No. field to your VAT Due liability account (2-xxxx).

• Debit the value of the goods imported and use the PV IMPORTS VAT Code. You could add a line for each import to make each item / purchase clear or you could summarise the total value.

• Note: If you are referring to the Monthly postponed import VAT statement report from HMRC, the amount of VAT due can be used to work out the value of the goods imported. You will need to divide the VAT due amount by the standard rate of VAT e.g. 20 and multiply this by 100 to get the value of goods as per HMRC records and valuation, which will most likely differ to the actual value based on the payment made to the suppliers due to exchange rate differences. For example, if the VAT Due shown is £200 and based on a standard VAT rate of 20%, then the value of goods in this case would be the sum of (£200/20)x100 = £1000 as per our example.

• To balance the journal, Credit the total value of all imports on a new line, again using the same VAT Due liability account, but this time use VAT Code N-T for this balancing line.

Example:

• Check your journal lines and ensure it balances. Once checked, click Record.

If you decide not to register for Postponed VAT accounting, then you can pay for the VAT 'up front' or when due at the tax point date. For example, if you ship the goods yourself you could pay at customs.

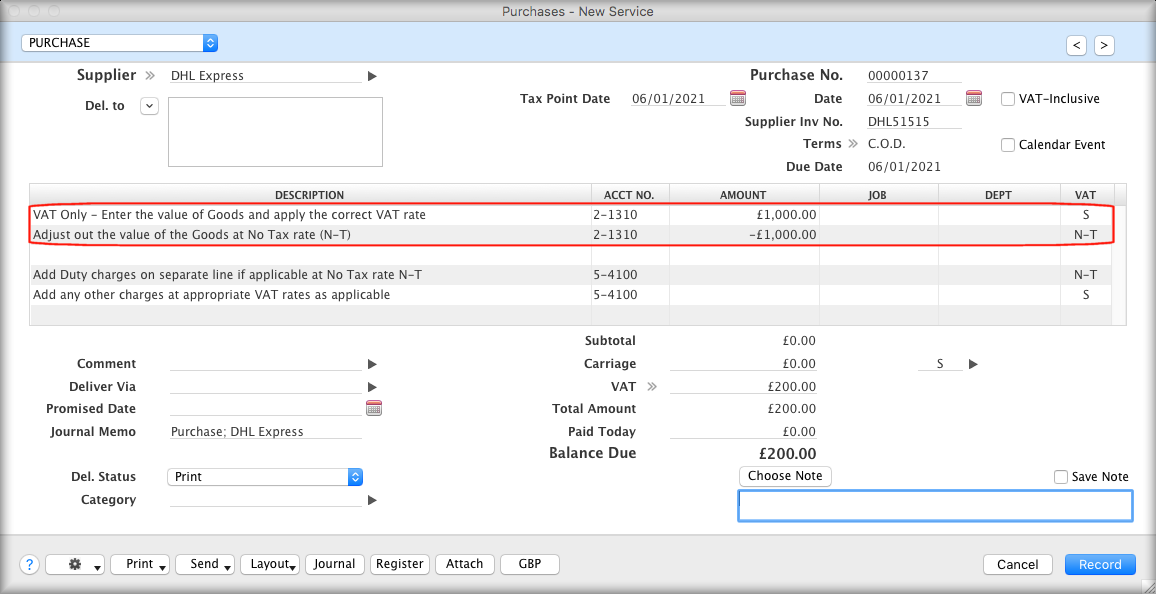

Alternatively, there may be occasions or circumstances where your shipping agent (DHL, UPS, etc.) bills you directly for the VAT on the value of the goods. For example, this might happen where the supplier didn't have your company's EORI number.

Both of these situations would be treated similarly: The original supplier's invoice would normally be recorded using VAT Code N-T to avoid the value of the goods being reported twice on your VAT returns. The shipping agent's separate 'VAT only' purchase invoice would then be recorded, which updates the VAT return with the appropriate goods and tax values.

The VAT invoice can be recorded in multiple lines:

• To deal with the VAT element, record the value of the goods, for example £1000 at standard VAT rate S. This generates VAT of £200.

• On a second line, subtract the value of the goods using VAT Code N-T (No Tax). For example, -£1000 @ N-T, this would leave you with only the £200 VAT on the invoice.

On the VAT return, the value of the goods will be reported in Box 7 and VAT reclaimed in Box 4.

• Add any other charges on additional lines as normal.

Example:

We recommend you contact HMRC or your shipping agent for any accounting or VAT treatment clarifications you require.